Have you ever actually read credit card terms and conditions? We have. Here’s what you need to know.

Several terms in your credit card agreement don’t benefit you—and they may actually harm your credit and financial hygiene. Here we look at one such agreement.

Having a credit card has its benefits. A credit card can add a layer of security when making online purchases, boost your credit history and score, provide you with emergency funds, and earn you rewards for spending. However, several terms in your credit card agreement don’t benefit you—and they may actually harm your credit and financial hygiene.

In this post, we look at a sample Credit Card Agreement for Bank of America® accounts. We only reviewed this agreement, but most credit card agreements feature similar terms.

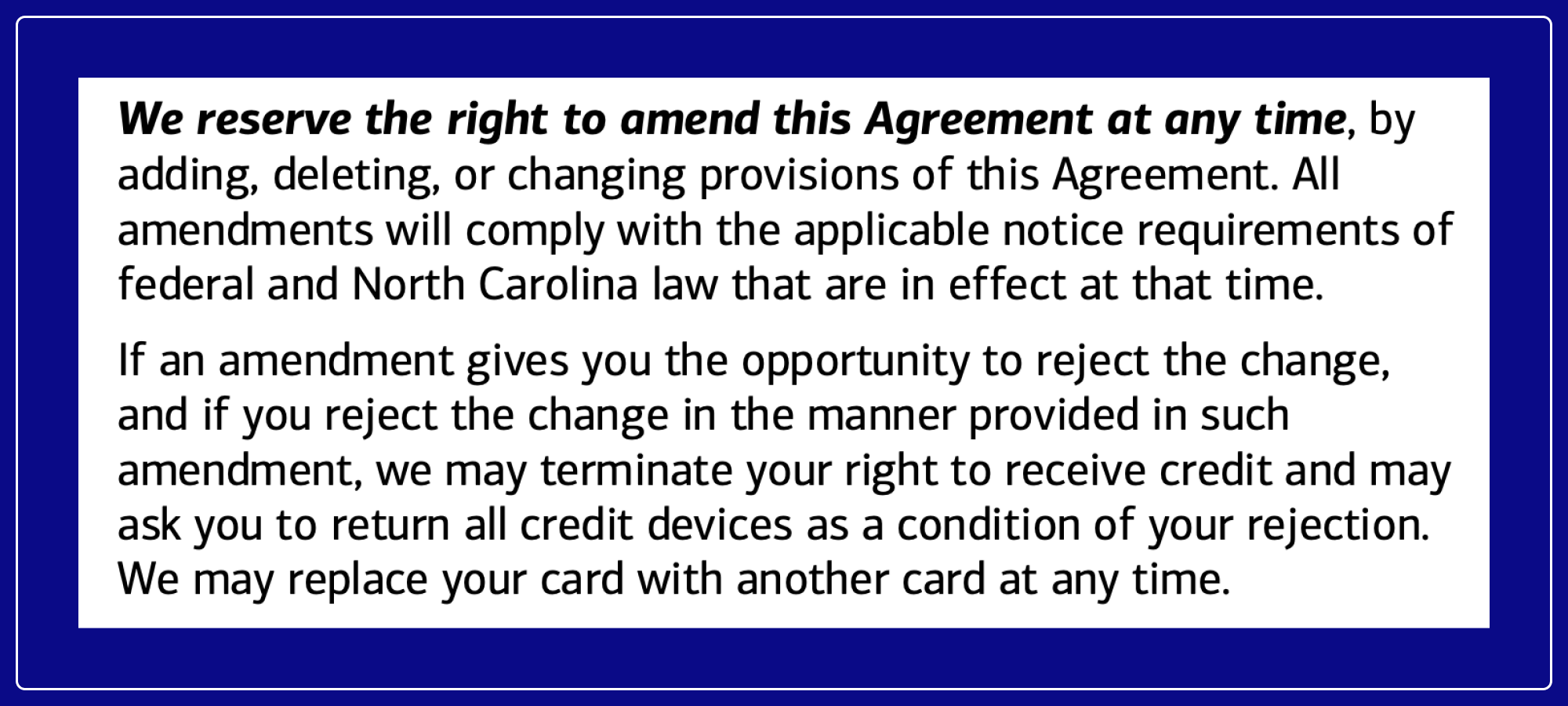

#1: They can change any of these terms, at any time

“We reserve the right to amend this Agreement at any time, by adding, deleting, or changing provisions of this Agreement.”

Almost every credit card agreement gives the credit card issuer (the bank giving you credit) the right to amend the agreement upon notice given to the card holder (you). Occasionally you’ll see a notice period: the time between when you’re notified of the change and when the change is effective. These notice periods depend on the type of change and whether a state or federal law mandates this period before a change goes into effect.

In this sample agreement, if there’s a notice period, you’re given the opportunity to reject the change. The agreement may be terminated if you reject the change. Usually this means that you either accept the changes or stop using the product. But when have you ever rejected a term change in any update for any product? A majority of card holders will merely glance at the notice and quickly agree to the term changes—totally understandable if you can’t negotiate the term change.

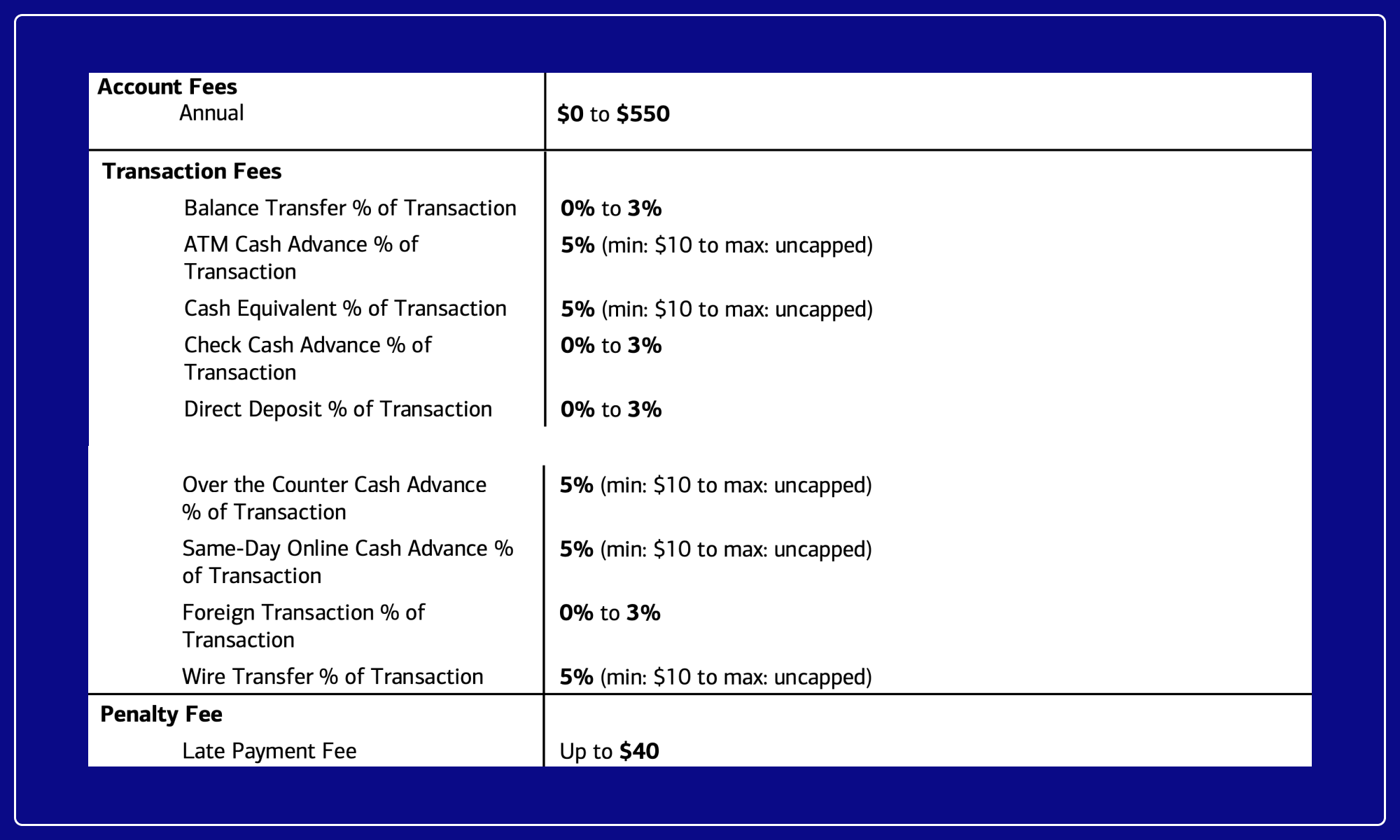

#2: So. Many. Fees.

Balance Transfer Fee, ATM Cash Advance Fee, Check Cash Advance Fee, Over the Counter Cash Advance Fee, Same-Day Online Cash Advance Fee, Foreign Transaction Fee, Wire Transfer Fee, Penalty Fee, Late Payment Fee….

Everyone knows that credit cards come with fees. It makes sense that you would be charged a fee for a late payment. But why is there a late payment fee and a penalty fee? The moment a user starts to use their credit line, fees stack up quickly—and intensely. As you’ll see, the APY per transaction can dramatically increase.

Besides expecting a cardholder to pay off their entire line of credit every month, what about these other fees? Fees for cash advances or wire transfers penalize the cardholder for using services offered as a benefit. These types of transactions will often (along with the fee) start accruing interest immediately, and they usually aren’t included in rewards calculations.

In addition, even if you didn’t intend for the transaction to be a wire or cash advance, some types of purchases will sometimes be coded as such. For example: purchases at casinos or other gambling locations or websites, rent or mortgage payments, and purchasing cryptocurrencies.

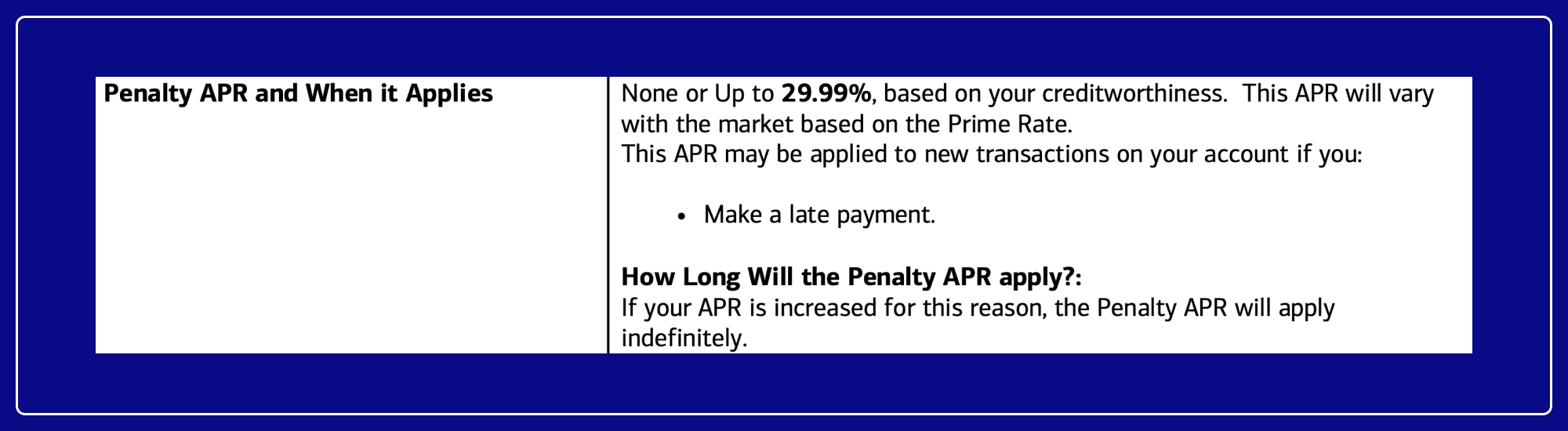

#3: Penalty APRs are variable depending on your creditworthiness

“The Penalty APR is the APR(s) which may be applied to new Purchases, Balance Transfers, and Cash Advances, for certain default occurrences as described below. We may increase the APRs on new transactions up to the Penalty APR, based on your creditworthiness, each time a Total Minimum Payment Due is not received by its applicable Payment Due Date.”

If you don’t pay off your credit card balance at the end of the month, the remaining balance is charged a fee. You're usually given a range of APY in your agreement that the credit card issuer may charge. However, if you forget to make a payment or two, those fees can increase—and remain at this increased rate indefinitely.

The rates of those fees will be calculated with a combination of your creditworthiness and, usually, the highest U.S. Prime Rate (as published in the “Money Rates” section of The Wall Street Journal). Credit card issuers must give you a minimum of 45 days advance notice before increasing these fees.

#4 Your benefits and rewards are not protected

“We may offer you certain benefits and services with your account… We may adjust, add, or delete benefits and services at any time and without notice to you.”

You may get a credit card for the benefits. The points. The cash back. The rewards. Sadly, these rewards aren’t as protected as other aspects of credit card use. And so they are often devalued, removed, or otherwise changed to the detriment of the credit card user (that’s you). No regulation protects the permanency of these rewards.

That said, regulations do exist to protect rewards advertising. For example, one credit card issuer was found to have violated Sections 1031 and 1036 of the CFPA, which prohibit deceptive acts or practices.

A credit card issuer advertised to consumers that they would receive certain bonuses if they opened new credit card accounts, responded to the advertisement and met certain spending requirements. However, the credit card issuer failed to disclose that the consumers must apply online for the new credit card to receive the bonus.

In closing, terms and conditions exist in part to provide transparency to you, the consumer, in an attempt to better understand what you’re signing up for. Yet let’s face it: most people scroll down the page as quickly as possible to click “accept” without reading a word.

Companies know this fact. And so they’re able to slip in terms that don’t benefit you in the long run. Sometimes, a little diligence goes a long way.

You should always know what clicking “accept” entails. It could save you a lot of frustration in the long run.