What do you really value in life—and how do you value the right things?

The endowment effect is a cognitive bias that causes us to believe our personal possessions are worth more than market value.

We like to believe that we’re rational actors in all facets of life. Our biology tells a different story.

No matter how logical we fancy ourselves to be, emotions come before logic. How we process and act upon those emotions is another story. But we must always recognize that emotional biases will influence our decision-making process.

Nothing highlights this better than the endowment effect, a cognitive bias that causes us to believe our personal possessions are worth more than market value.

The value of a life

Behavioral economist, Richard Thaler, wanted to know the value of a life. As a founder of the field of behavioral economics, he knew this was a longstanding philosophical question. But what did economics have to say?

Based on his 1976 paper on the topic, around $7 million per life saved—a figure still used in governmental cost-benefit analyses.

While working on this topic, he became interested in researching trade-offs people take between money and the risk of dying. One paper detailing Russian roulette was informative but didn’t strike an emotional chord. Thaler wanted to design a study that impacted people emotionally enough to elicit a real response.

What follows are two questions Thaler asked students, reprinted from his book, Misbehaving.

- Suppose by attending this lecture you have exposed yourself to a rare fatal disease. If you contract the disease you will die a quick and painless death sometime next week. The chance you will get the disease is 1 in 1,000. We have a single dose of an antidote for this disease that we will sell to the highest bidder. If you take this antidote the risk of dying from the disease goes to zero. What is the most you would be willing to pay for this antidote? (If you are short on cash we will lend you the money to pay for the antidote at a zero rate of interest with thirty years to pay it back.)

- Researchers at the university hospital are doing some research on that same rare disease. They need volunteers who would be willing to simply walk into a room for five minutes and expose themselves to the same 1 in 1,000 risk of getting the disease and dying a quick and painless death in the next week. No antidote will be available. What is the least amount of money you would demand to participate in this research study?

According to longstanding economic theory, the two rates should be relatively the same. Thaler knew economic theory doesn’t account for how people actually act in the world. His findings highlight this fact.

In version A, most people replied that they would not pay more than $2,000 for the antidote. But in version B, they would not accept less than $500,000 to participate in the study. A number of students said no amount of money would suffice.

Thaler realized something was going on with the value people put on possessions—in this case, their lives. In one case, people were already “in possession” of the disease, whereas in the second, they were being asked to put themselves in a situation where they could become infected. Another factor, offered by economics department chairmen and wine enthusiast Richard Rosett, gave shape to the effect.

Surcharge versus discount

Rosett had acquired bottles of wine for $10 that were now worth over $100. He would gladly drink one on occasion, yet he refused to sell even one to a wine merchant who was offering 10x his original purchase price. Thaler notes that the opportunity cost in each scenario is the same, yet they produce completely different outcomes—a fact that Rosett admitted was true. Rosett recognized that he was being irrational and still couldn’t change his mind.

Then another friend, Tom Russell, introduced Thaler to an interesting parallel use case. Due to interchange fees, some gas stations were raising the price of gas for credit card holders (a phenomenon that still happens at stations today). You would be charged $1.03 when paying with a credit card for every $1 that cash users had to pay.

Here’s the kicker: some gas station owners called this charge a discount for cash users. Others called the added fee a surcharge. Turns out the credit card industry strongly preferred the term “discount.” Economic theory once again said framing shouldn’t matter. But human psychology isn’t a spreadsheet.

As Thaler writes,

Paying a surcharge is out-of-pocket, whereas not receiving a discount is a ‘mere’ opportunity cost.

Language matters in all of these cases. These factors shaped what Thaler calls the endowment effect. As he puts it,

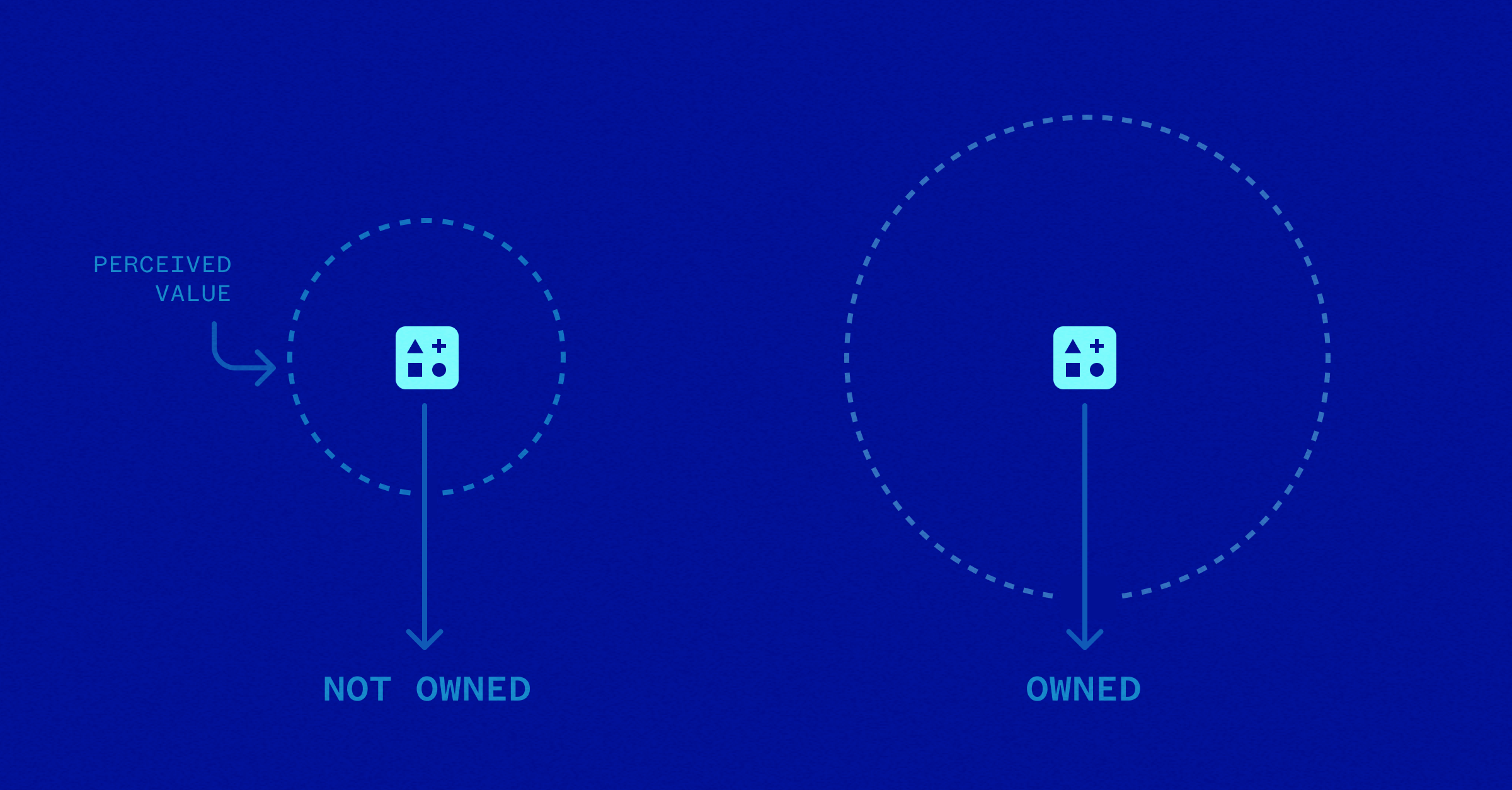

I had stumbled upon a finding that suggested people valued things that were already part of their endowment more highly than things that could be part of their endowment, that were available but not yet owned.

Interesting effect, but then Thaler wondered, what does it really mean?

Know your value

Later studies with college students involving pens, coffee mugs, and tokens would reiterate what Thaler had observed: we value what we own, sometimes—and this is the important part—to our detriment.

The endowment effect plays into other cognitive biases, including loss aversion (losses hurt more than equivalent gains) and status quo bias (people prefer that things remain the same, even if against their own best interests).

The combination of these three biases work in conjunction as a force that causes us to resist change.

Thaler notes that people who lose their jobs due to a plant closing down are thrust back into the job market, whereas people employed at dangerous or underpaid occupations are more likely to experience inertia and not get back on the market.

They value what they have, even if what they have isn’t working for them.

Cognitive biases are powerful forces that sometimes cause us to make decisions against our best interest. At times what we have really isn’t serving us and needs to be reconsidered. But that’s not always the case.

There’s the value of a life in terms of facing death, but then there’s the value of the life you live. And that’s just as important to consider when making decisions about what you value. It might make sense to value what you have, but it makes even more sense to change when you’re not earning your true value.