What is APY?

The annual percentage yield (APY) that financial services offer is your key to maximizing wealth. Understanding it is essential for getting the most out of your money.

One of the biggest questions people have when choosing a place to store their money is: How can I get the most return on my savings? This is where APY comes into play.

APY is an acronym for annual percentage yield. Your financial institution’s APY lets you measure the amount of money you’ll earn on an interest-bearing account when it’s been annualized over the course of a year.

Many different financial services offer an APY. While the term is usually applied to a savings account, other accounts offer yield, including some checking accounts, cash management accounts, money market accounts, and certificates of deposit.

Checking accounts tend to have lower APY because they’re generally reserved for cash on hand for immediate expenses. Savings accounts, by contrast, signal that money is going to be stored for a longer period of time. Knowing that money will likely not be withdrawn, banks lend that money for mortgage and other loans, which results in higher APY returned to you (though often far below the rate they’re earning on your money).

To avoid confusion over varying APY percentages, Eco created one simple balance so that whatever you’re using your money for, you know it’s immediately accruing our market-leading APY rewards.

How APY works

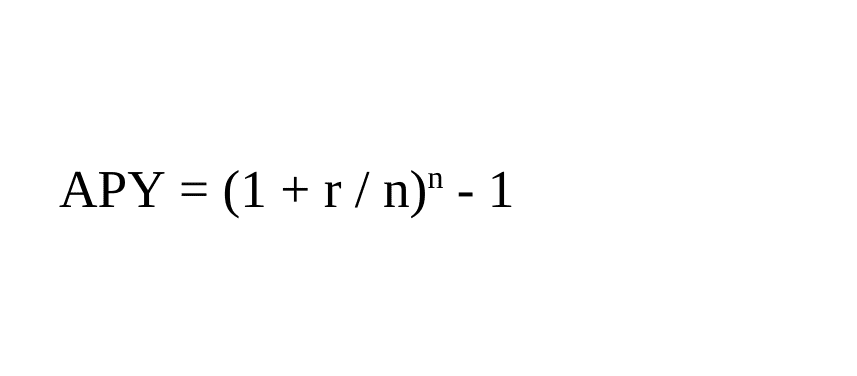

If you want to get the most out of your money, it’s important to know how APY works. Whether you have specific savings goals, are storing into a retirement fund, or just broadly want to earn the best yield, the following formula applies to your account.

Here’s how the formula works in your account.

Let’s say you have $5,000 in a savings account with a traditional bank, earning the typical APY of .19%. Here’s what your account will look like over time.

- 1 year: $5,009.51

- 5 years: $5,047.72

- 10 years: $5,095.90

- 20 years: $5,193.64

- 30 years: $5,293.26

Now let’s look at the same investment in an Eco account with 5.0% APY.

- 1 year: $5,255.81

- 5 years: $6,416.79

- 10 years: $8,235.05

- 20 years: $13,563.20

- 30 years: $22,338.72

Compound interest matters

Compound interest is the secret to building and maximizing wealth. This is the interest that’s paid on your principal deposit and accrued interest on the principal.

If you’re earning 5% APY on $5,000, after one month your account would be worth $5,020.83. That means next month you’ll earn interest on that amount, not just your original deposit.

It’s important to note the compounding schedule when choosing a financial service. Some accounts compound monthly (like Eco), while others compound annually, which will not grow your account as quickly. The more often it compounds, the better it is for you.

Also note whether your financial service offers simple interest or compound interest. Simple interest in a savings account means the APY will apply only to money you put into your account and not the accrued interest. Compound interest applies to both your principal deposit (and any future deposits) as well as accrued interest.

Variable APY

Another aspect of APY to watch out for is variability. Sometimes a variable APY can be beneficial, such as when your financial service increases your rate. The opposite is true as well: traditional banks often lower rates based on current macroeconomic pressures.

Thus, if the national benchmark rate decreases, it’s likely that your APY will decrease. In particular, APY in savings accounts tend to adjust alongside the federal funds rate.

Pay particular attention to asterisks posted next to APY offers. Some banks offer a high APY on a set amount of money (such as 5% on the first $1,000) and then a much lower APY on any deposit above that amount.

What about interest rates…

While the terms “interest rate” and “APY” are sometimes used interchangeably, an interest rate doesn’t capture the effects of compounding rates. APY explicitly states the interest rate and the compounding rate. The APY offers a holistic overview to see what you’ll earn on an account.

For example, there’s a big distinction between an interest rate that compounds monthly compared to an interest rate that compounds annually. Just seeing a high interest rate doesn’t necessarily mean the compound rate will be in your favor.

Lastly, APY and APR (annual percentage return) are also different. APR is the amount of interest you pay on a loan and is not associated with interest-bearing accounts. Whereas a higher yield is better with an APY, the opposite is true with APR. That’s why it’s always important to read the terms and conditions when signing up for a credit card.